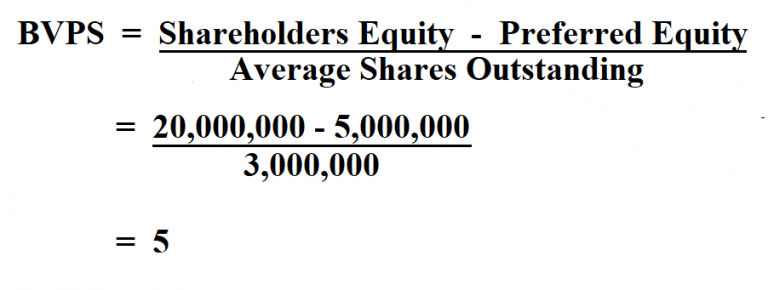

This reduces the stock’s outstanding shares and decreases the amount by which the total stockholders’ equity is divided. For example, in the above example, Company X could repurchase 500,000 shares to reduce its outstanding shares from 3,000,000 to 2,500,000. Whereas some price models and fundamental analyses are complex, calculating book value per share is fairly straightforward. At its core, it’s subtracting a company’s preferred stock from shareholder equity and dividing that sum by the average amount of outstanding shares. Book value per share (BVPS) is calculated as the equity accessible to common shareholders divided by the total number of outstanding shares.

A stock is considered undervalued if the book value per share is more than the price at which it trades in the market. When looking at the financial statements of a business, look for information about stockholders’ equity, also known as owner’s equity. When preferred shares are not present, the entire equity of the stockholders is utilized.

As a company’s potential profitability, or its expected growth rate, increases, the corresponding market value per share will also increase. Common stocks from its shareholders, the company can increase the book value per share from Rs. 8 to Rs. 10. Market value per share and book value per share are both metrics used to gauge the value of a stock but are different assessments.

Book value per share (BVPS) tells investors the book value of a firm on a per-share basis. Investors use BVPS to gauge whether a stock price is undervalued by comparing it to the firm’s market value per share. Book value refers to a firm’s net asset value (NAV) or its total assets minus its total liabilities. Notice on the balance sheet that they have reduced that value from the total shareholders’ equity. We can find the outstanding shares at the bottom of the income statement or the beginning of the 10-K or 10-Q. A common way of increasing BVPS is for companies to buy back common stocks from shareholders.

These articles have been prepared by 5paisa and is not for any type of circulation. 5paisa shall not be responsible for any unauthorized circulation, reproduction or distribution of this material or contents thereof to any unintended recipient. Kindly note that this page of blog/articles xero for dummies cheat sheet does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. This article is prepared for assistance only and is not intended to be and must not alone be taken as the basis of an investment decision.

BVPS is typically calculated quarterly or annually, coinciding with the company’s financial reporting periods. While Book Value Per Share can be a helpful indicator of a company’s tangible net assets, it has several limitations that investors should be aware of. For example, if a company has a total asset balance of $40mm and liabilities of $25mm, then the book value of equity (BVE) is $15mm. An asset value at which it can be sold matters as it is used to pay shareholders at liquidation.

Along with return on equity, return on assets, and return on invested capital, this formula can help us find the real value of a company. To see how easy this is, let’s look at a few companies and balance sheets to learn how to calculate this formula. Shares outstanding, as we will use them, are for shares at the end of the period. When a company has a high book value per share, it may signify its strategic emphasis on sustainability. Book value per share holds a significant relationship to a company’s commitment to Corporate Social Responsibility (CSR) and sustainability.

Essentially, book value per share and market value per share are measures that investors use to gauge a company’s worth, but they approach it from two different perspectives. The following image shows Coca-Cola’s “Equity Attributable to Shareowners” line at the bottom of its Shareowners’ Equity section. It’s one metric that an investor may look for if they’re interested in valuating Coca-Cola as a potential investment. As suggested by the name, the “book” value per share calculation begins with finding the necessary balance sheet data from the latest financial report (e.g. 10-K, 10-Q). Therefore, the book value per share (BVPS) is a company’s net asset value expressed on a per-share basis. As always, remember that finding a great book value per share is not the end all, be all for locating a great company to invest in.

As noted above, another way to calculate book value is to subtract a business’ total liabilities from its total assets. In simple words, book value is the sum available for shareholders in case a company gets liquidated. BVPS is theoretically the amount shareholders would get in the case of a liquidation in which all physical assets are sold and all obligations are satisfied. However, investors use it to determine if a stock price is overvalued or undervalued based on the market value per share of the company.