As you can see, the net profit has increased from $1.50 to $6.50 when the packets sold increased from 1000 to 2000. However, the contribution margin for selling 2000 packets of whole wheat bread would be as follows. Thus, you need to make sure that the contribution margin covers your fixed cost and the target income you want to accounts payable and invoice automation best practices achieve. However, when CM is expressed as a ratio or as a percentage of sales, it provides a sound alternative to the profit ratio. The best contribution margin is 100%, so the closer the contribution margin is to 100%, the better. The higher the number, the better a company is at covering its overhead costs with money on hand.

As with other figures, it is important to consider contribution margins in relation to other metrics rather than in isolation. A key characteristic of the contribution margin is that it remains fixed on a per unit basis irrespective of the number of units manufactured or sold. On the other hand, the net profit per unit may increase/decrease non-linearly with the number of units sold as it includes the fixed costs. The contribution margin is important because it gives you a clear, quick picture of how much “bang for your buck” you’re getting on each sale. It offers insight into how your company’s products and sales fit into the bigger picture of your business. If the contribution margin for a particular product is low or negative, it’s a sign that the product isn’t helping your company make a profit and should be sold at a different price point or not at all.

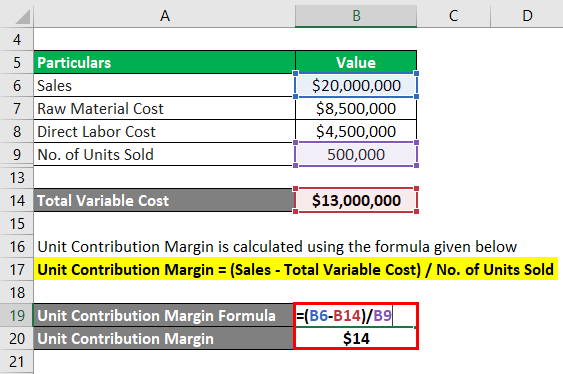

Thus, here we use the contribution margin equation to find the value. When there’s no way we can know the net sales, we can use the above formula to determine how to calculate the contribution margin. In the Dobson Books Company example, the contribution margin for selling $200,000 worth of books was $120,000. Now, let’s try to understand the contribution margin per unit with the help of an example.

The calculator will not only calculate the margin itself but will also return the contribution margin ratio. The balance between fixed and variable costs carries significant weight in strategic planning. Understanding this interplay helps managers optimize decisions around pricing, production and resource allocation.

A marketing executive might leverage this information to craft sales targets that align perfectly with the company’s financial goals. A business can increase its Contribution Margin Ratio by reducing the cost of goods sold, increasing the selling price of products, or finding ways to reduce fixed costs. A high Contribution Margin Ratio indicates that each sale produces more profit than it did before and that the business will have an easier time making up fixed costs. A low Contribution Margin Ratio, on the other hand, suggests that there may be difficulty in covering fixed costs and making profits due to lower margins on individual sales.

Thus, CM is the variable expense plus profit which will incur if any activity takes place over and above BEP. Based on the contribution margin formula, there are two ways for a company to increase its contribution margins; They can find ways to increase revenues, or they can reduce their variable costs. Management uses the contribution margin in several different forms to production and pricing decisions within the business. This concept is especially helpful to management in calculating the breakeven point for a department or a product line.

So it is necessary to understand the breakup of fixed and variable cost of any production process. The contribution margin measures how much money each additional sale contributes to a company’s profits. Business owners generally use the contribution margin ratio on a per-product basis to determine the portion of sales generated that can contribute to fixed costs. And as we mentioned earlier, a negative margin indicates the cost of producing the product exceeds its revenue. As mentioned above, the contribution margin is nothing but the sales revenue minus total variable costs. Thus, the following structure of the contribution margin income statement will help you to understand the contribution margin formula.

It helps companies decide whether to add or subtract a product line, how to price a product or service and how to structure sales commissions or bonuses. Consider its name — the contribution margin is how much the sale of a particular product or service contributes to your company’s overall profitability. It’s how valuable the sale of a specific product or product line is.

This metric is typically used to calculate the break even point of a production process and set the pricing of a product. They also use this to forecast the profits of the budgeted production numbers after the prices have been set. Another common way to look at contribution margin is as a ratio expressed as a percentage.