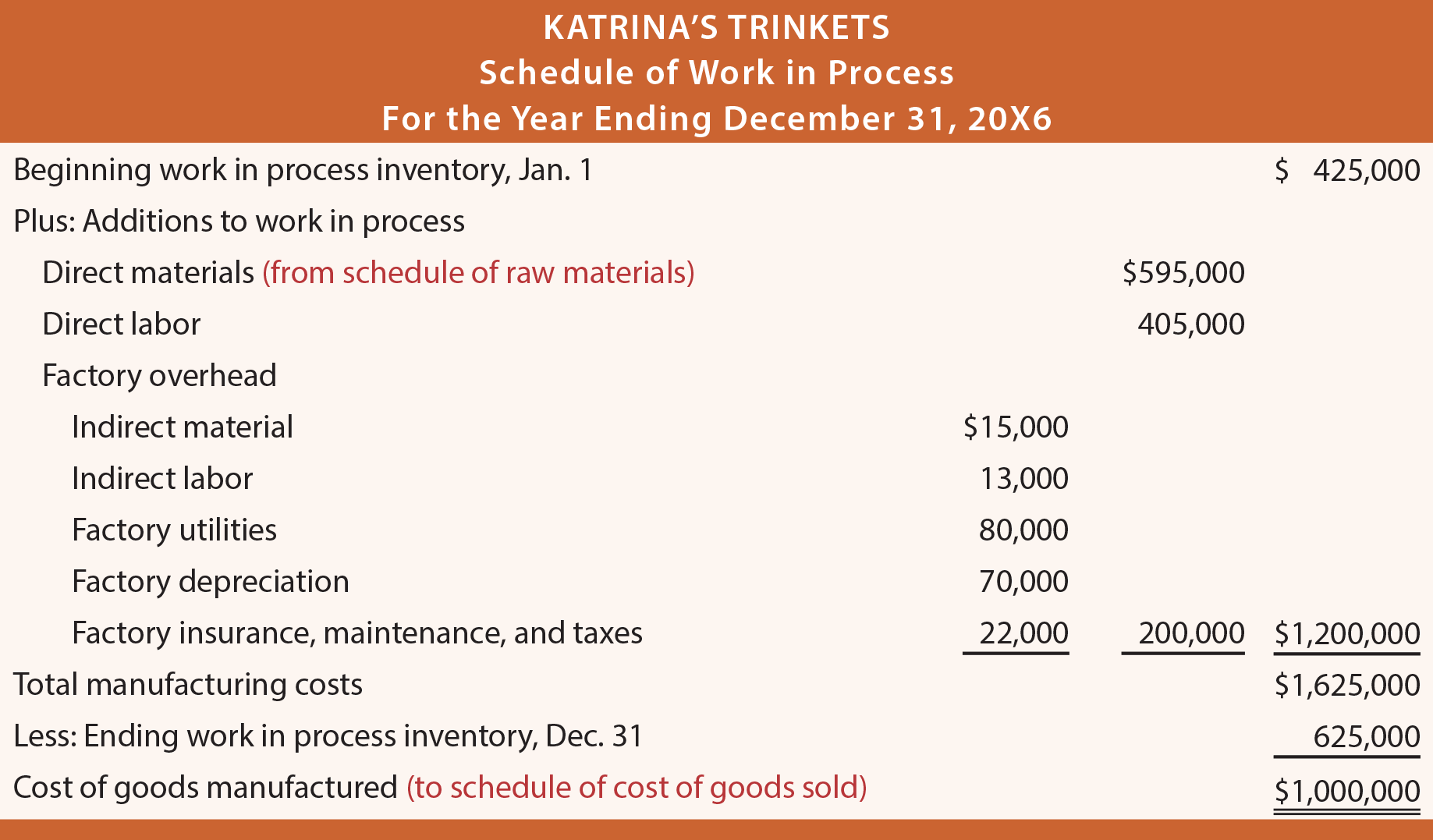

All of our content is based on objective analysis, and the opinions are our own. Revenue recognition can be complex in manufacturing, particularly with long-term contracts. Errors often occur when revenue is recognized prematurely which occurs before products are completed or shipped.

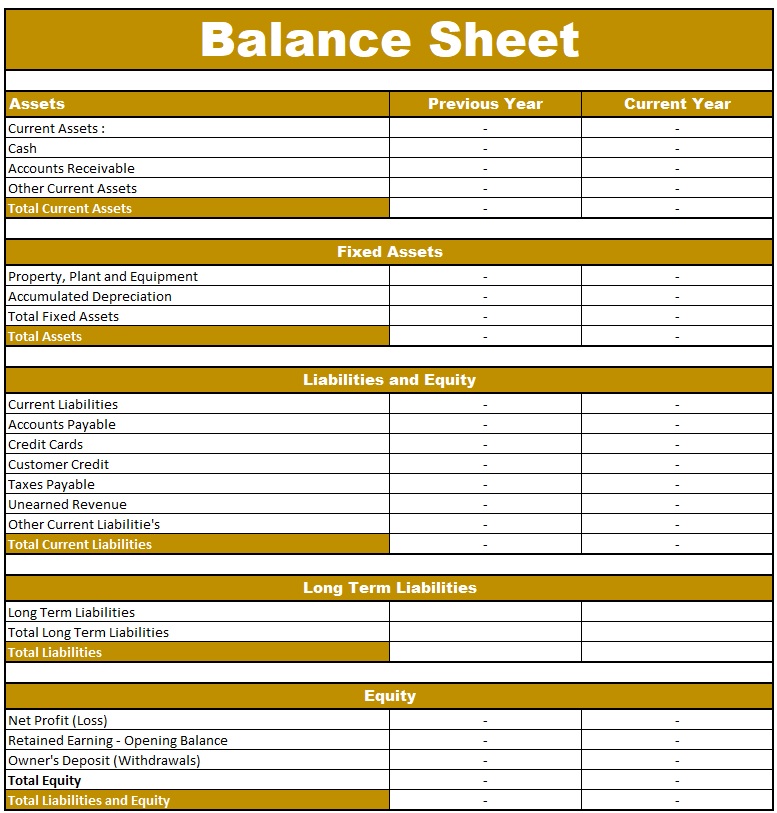

A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries. Current liabilities are due within one year and are listed in order of their due date. Updates to your application and enrollment status will be shown on your account page.

Regularly reconciling inventory records with physical counts helps prevent discrepancies. This practice ensures that the values of raw materials, work-in-progress, and finished goods are accurately reflected in financial reports, which is crucial for informed decision-making. Consequently, reliable financial past year tax 2021 reporting supports effective planning, budgeting, and performance management, enabling manufacturers to optimize their operations and enhance profitability. This statement is crucial for evaluating the company’s financial position and understanding its ability to meet obligations and invest in growth.

When analyzed over time or comparatively against competing companies, managers can better understand ways to improve the financial health of a company. Each category consists of several smaller accounts that break down the specifics of a company’s finances. These accounts vary widely by industry, and the same terms can have different implications depending on the nature of the business. Companies might choose to use a form of balance sheet known as the common size, which shows percentages along with the numerical values.

A company can use its balance sheet to craft internal decisions, though the information presented is usually not as helpful as an income statement. A company may look at its balance sheet to measure risk, make sure it has enough cash on hand, and evaluate how it wants to raise more capital (through debt or equity). Employees usually prefer knowing their jobs are secure and that the company they are working for is in good health. A company usually must provide a balance sheet to a lender in order to secure a business loan. A company must also usually provide a balance sheet to private investors when attempting to secure private equity funding. In both cases, the external party wants to assess the financial health of a company, the creditworthiness of the business, and whether the company will be able to repay its short-term debts.

As you can see, the report format is a little bit easier to read and understand. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. A lot of times owners loan money to their companies instead of taking out a traditional bank loan. Investors and creditors want to see this type of debt differentiated from traditional debt that’s owed to third parties, so a third section is often added for owner’s debt. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Furthermore, manufacturing firms account for work-in-progress, representing partially completed products, a concept that non-manufacturing companies do not engage with. Regardless of the size of a company or industry in which it operates, there are many benefits of reading, analyzing, and understanding its balance sheet. Current and non-current assets should both be subtotaled, and then totaled together. Using the cost flow equation, you can see how failing to record the $9,000,000 loss would understate cost of goods sold.